HVR Energy funding in order to build its first 20 hydrogen distribution stations (ACTIVA) intended to supply vehicles.

Some updates since the launch of round 1 :

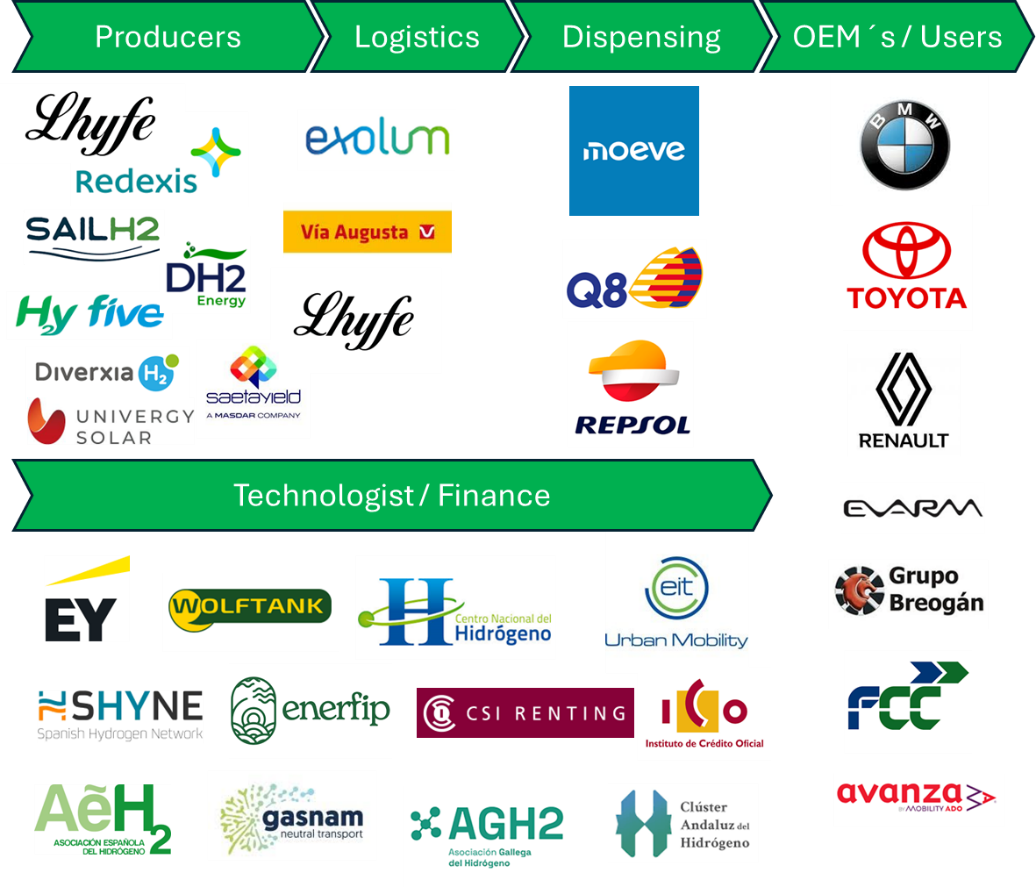

Since the launch of round 1 (1,500,000 EUR), HVR Energy has secured strategic partnerships with several companies in the energy and automotive sectors.

Moreover, the initial target of installing 20 stations by 2027 has been revised upwards. The new objective is now 25 ACTIVA stations, representing a 20% increase in the number of subsidized stations since the launch of round 1, reflecting the interest this model generates among European and Spanish authorities.

Since the launch of round 2 (EUR 1,000,000), HVR Energy has completed the installation and commissioning of the first ACTIVA station on BMW’s test track in France. The performance has exceeded all expectations.

Moreover, with the aim of diversifying its client portfolio, HVR Energy has also launched a new offer targeting independent fuel stations (over 5,000 in Spain), based on an innovative compensation model for the installation of hydrogen stations. Initial discussions with interested operators are underway.

Finally, the company’s financing plan also includes two major updates:

- A strategic agreement has been signed with CSI Renting de Tecnología, S.A.U. to explore financing of up to EUR 25 million.

- ICO has approved EUR 13 million in financing to support the deployment of the 30 stations included in the CEF 30 plan.”

For this fourth tranche, the news comes with the same momentum :

- ICO financing now amounts to €20 million (€7m + €13m).

- The company now wishes to bring in additional partners to the venture and has initiated discussions to open its capital to the following potential entities: Arcano – (Venture Capital), Suma Capital – (Private Equity), Dunas Capital – (Infrastructure Fund), Aeex Capital – (Infrastructure Fund), Buenavista Capital – (Infrastructure Fund), Axon Partners – (Private Equity), Q Energy – (Private Equity), and two of them have already submitted an LOI.

- Finally, still with the objective of fostering the use of green hydrogen, HVR Energy is now exploring options to provide refueling solutions in ports and marinas.

The essentials :

This project concerns HVR Energy corporate financing. The company will use the funds to build its first 20 hydrogen refueling stations (ACTIVA type).

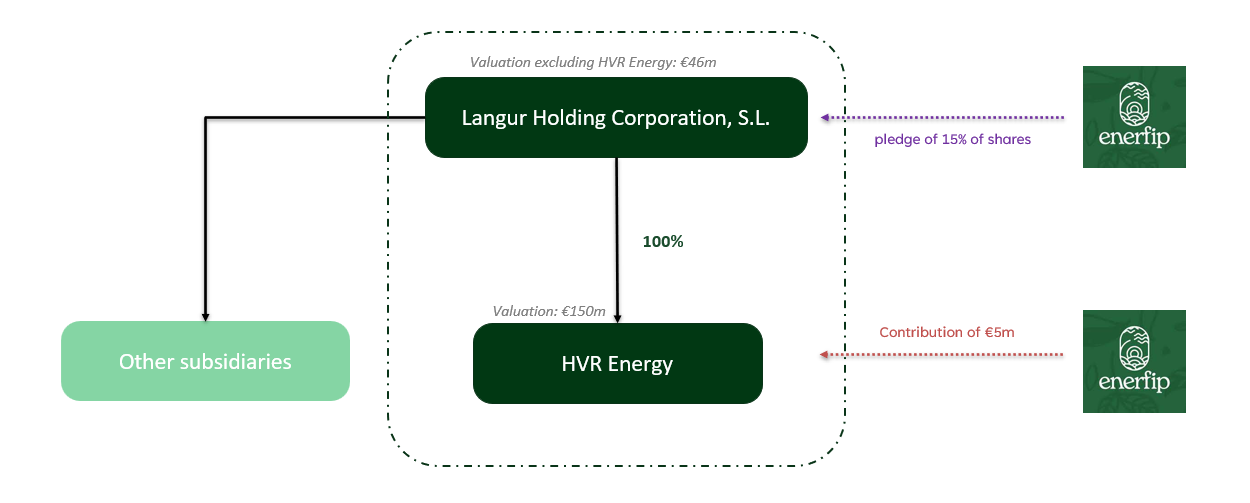

The amount requested for the fourth round of funding is 1,636,320 EUR, for a total of 5,000,000 EUR, in several rounds, with an investment term of 48 months (since the closing date of round 1) and an interest rate of 12%. The simple bonds issued are of senior range.

A pledge of 15% of the shares of the parent entity, Langur Holding Corporation, S.L. is settled as a guarantee.

The offer

Details and characteristics of the offer

20 hydrogen refueling stations construction funding along the Trans-European Transport Network

HVR Energy offers an investment opportunity in the financing of the construction of its first 20 hydrogen refueling station in Spain.

The interest rate of the simple bonds issued as part of this project is 12%, with a duration of 48 months (since the closing date of round 1). The repayment strategy is in fine with an annual interest payment.

These are regulated by Spanish jurisdiction.

The repayment strategy is based on increasing equity and on obtaining grants. The promise will cover the 15% of the shares of Langur Holding Corporation, S.L. the parent company.

The project

What will your investment fund?

HVR Energy is a Spanish company founded in 2020 that develops hydrogen refueling stations and currently operates a project for production, storage, and distribution of green hydrogen in Coslada (Spain). This first installation serves as a show platform.

The company produces and distributes green hydrogen by purchasing electricity through green energy contracts.

The company offers solutions in various sectors and for various applications:

- Mobility: urban mobility, interurban mobility, and light vehicles

- Logistics: heavy transport, light transport, last-mile transport, as well as forklifts

- Data centers:Memorandum of Understanding signed with Nvidia and certified as official H2 supplier to supply hydrogen in Nvidia data center backup systems

HVR energy works with car manufacturers, energy companies, and logistics companies to promote the use of hydrogen.

ACTIVA Type Stations:

ACTIVA is a distribution hydrogen project. This type of station will be installed in existing gas stations or directly in the facilities of companies that require a hydrogen supply (such as logistics operators and car manufacturers).

Features of an ACTIVA station:

- Distribution: dual connection at 350 bar and 700 bar

- Installed power: 15 kW

- Dispensing capacity: 1 ton/day

- Storage system: 900 bar

- Occupied surface: 20 m²

- Construction time: 6 to 8 months

The technology has been developed by Wolftank, an Austrian group and global player in energy solutions.

The 20 stations funding is part of a larger deployment strategy that foresees a total of 75 ACTIVA stations across Spain. Exact locations have not been precisely defined yet as the client will decide the exact location at the time of signing the contract.

The company development is based on an increase in capital and also on the support of European organizations:

- EIT (European Institute of Innovation & Technology)

- CEF (Connecting Europe Facility – European Commission)

- ICO (Instituto de Crédito Oficial)

The company has structured its operation by dividing it into implementation phases that are named after the awarded grant.

- EIT: 1 station (grant awarded)

- PATSYD: 4 stations (grant awarded)

- CEF 20: 20 stations (grant awarded)

- CEF 30: 30 stations (application submitted)

- CEF 20.2: 20 stations (application currently being finalized)

With the installation of the first 20 stations, HVR Energy aims to demonstrate the reliability of its model and gain credibility before launching a fundraising equity campaign.

The crowdfunding is carried out within the framework CEF 20 for which the grant has already been awarded.

Business Model:

1) The ACTIVA stations will be leased to two types of clients for a monthly rental:

- Traditional fuel companies with a distribution network settled

- Companies using hydrogen vehicles (cars, buses, trucks, forklifts)

In this way, HVR Energy ensures part of its income that will not be directly affected by hydrogen demand.

2) In addition, HVR Energy will also receive a commission of 0.5 € per kg of hydrogen sold.

The press is talking about the project!

- https://elperiodicodelaenergia.com/hvr-energy-recibe-ayudas-de-los-fondos-europeos-para-instalar-20-hidrolineras-en-espana/

- https://hidrogeno-verde.es/proyecto-hvr-energy-movilidad-hidrogeno/

- https://elperiodicodelaenergia.com/eit-apoya-la-propuesta-de-hvr-energy-para-potenciar-la-movilidad-impulsada-por-hidrogeno/

- https://www.bolsamania.com/noticias/empresas/economia–eit-apoya-la-propuesta-de-hvr-energy-para-potenciar-la-movilidad-impulsada-por-hidrogeno–18957380.html

- https://elmercantil.com/2025/02/24/la-comision-europea-apoya-con-65-millones-seis-proyectos-espanoles-en-fueles-verdes/

Project owners

Who will implement the project?

Langur Holding Corporation

Spain

Langur Holding Corporation

Founded in 2016, Langur Holding Corporation (LHC), a Spanish company, is a private entity created to manage minority and majority stakes in a variety of companies in Europe, LATAM, and GCC (Gulf Cooperation Council) countries.

Langur provides strategic consulting, business structuring expertise, and market penetration services to all the companies it invests in, across the following sectors:

- Energy sector

- Fintech

- Home services

The subsidiary Langur Portugal is dedicated to the development, construction, and operation of photovoltaic assets in Portugal.

2024

5.5 MWp already in service / 25 MWp of new developments in RTB phase / The entire portfolio is owned by WildSprout (50% of Langur Portugal).

2025

18 MW under negotiation (UPP) + 2 MW of distributed production / Energy communities: Pilot project of 10 MW (initial development) / Project development is carried out within Langur Portugal.

2028 (goals)

The goal is to develop, construct, and commission approximately 160 MWp by 2028: Decentralized production (self-consumption): 6 MWp / Decentralized production (UPP): 40 MWp / Decentralized production (energy communities): 10 MWp / Public utility scale (feed-in tariff): 3.5 MWp / Public service scale (market): 100 MWp.